NASDAQ Composite (^IXIC) Charts, Data & News

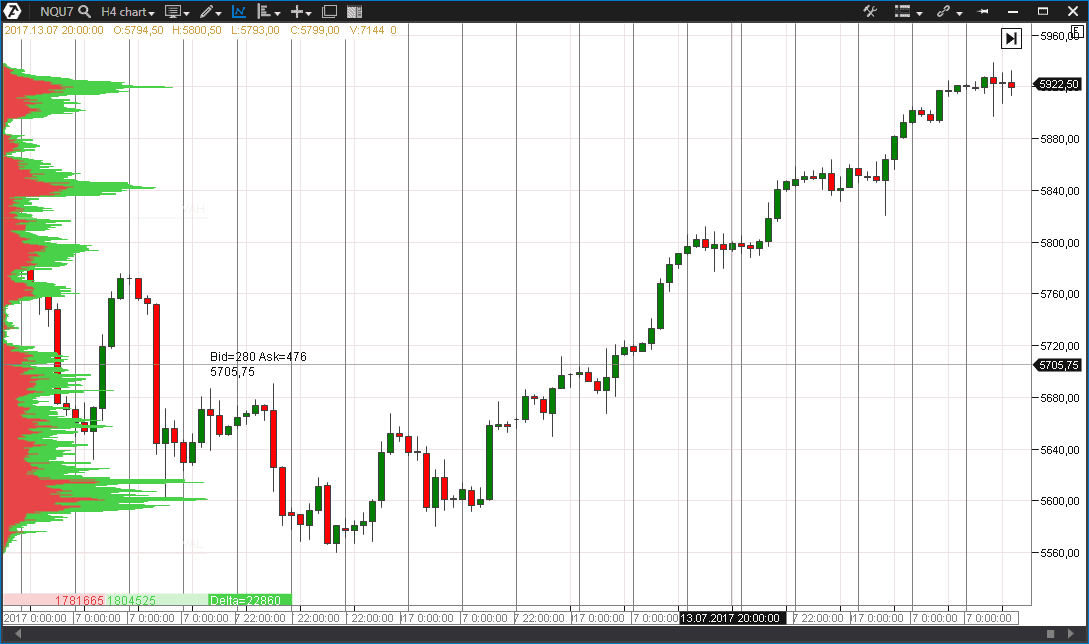

External links [ ]• High-priced growth stocks like Shopify have declined over the last couple of weeks as bond yields have risen and expectations of a rapid recovery from the pandemic are increasing. For example, the company must already have been listed on the Nasdaq for two years, and must have sufficiently high share capitalization and a certain trading volume. Teeter, Preston; Sandberg, Jorgen 2017. The total return index includes the reinvestment of cash dividends on their respective dividend ex-dates. ADRs• Understanding Nasdaq Composite Index The Nasdaq Composite is not limited to companies that have U. Two versions of the Nasdaq Composite Index are calculated: a price return index and a total return index. 2010s bull market [ ] The index closed 2012 at 3,019. NASDAQ Stocks: Information delayed 15 minutes. [ ] The Nasdaq Composite is a ; its price is calculated by taking the sum of the products of closing price and index share of all of the securities in the index. Watts, William August 13, 2020. Looks like the bubble continues until next summer. , , , , rights, , units and other are not included in the index. 24, 2003, both versions of the index were synchronized. In order to be included in the Nasdaq 100, a share must fulfill certain criteria. The types of securities in the index include , common stocks, REITs and , as well as limited partnership interests. The sum is then divided by a divisor which reduces the of the result. Think, we are in intermediate top, going now pending and afterwards short increase and. And this behaviour is shown every day in the chart. , , , , ,• , , , , ,• NASDAQ Composite - 45 Year Historical Chart Interactive chart of the NASDAQ Composite stock market index since 1971. The bubble will eventually pop, trying to figure out when. While no violations of support were generated, the Nasdaq Composite see above closed below its uptrend line once again, turning its trend to neutral, while the Nasdaq 100 closed back below its 50-day moving average. headquarters—something that sets it apart from a number of other indexes. looking at a 1 month charts, with the completition of the 5 th impulse elliot waves. Rising bond yields and talk of higher inflation has "spooked" markets slightly, but growing earnings expectations and pent-up consumer demand are among the factors that should ultimately offset those concerns, Frederick said. On June 9, 2020, the index traded above 10,000 for the first time. For example, if the Nasdaq-100 Index is up 100 points and in this column Cisco has a positive 10 point change, then 10 of the 100 point gain is attributable to Cisco. It might be hard to understand why many of the high-growth stocks that produced the Nasdaq's superior performance in 2020 would suddenly diverge from the rest of the market and head lower. The composition of the NASDAQ Composite is heavily weighted towards companies in the sector. It reached a price—earnings ratio of 200, dwarfing the peak price—earnings ratio of 80 for the Japanese during the of 1991. The index is calculated continuously throughout the trading day, but it is reported once per second, with the final confirmed value being reported at 4:16 p. The index declined to half its value within a year, and finally hit the bottom of the bear on October 10, 2002, with an intra-day low of 1,108. SRADERS, ANNE June 9, 2020. On September 29, 2008, the index fell nearly 200 points or 9. It has been published since 31 January 1985. The composition of the Nasdaq 100 and the weighting of the shares included in it are reviewed once annually and adjusted where necessary. On January 2, 2018, the index crossed 7,000 intraday. Even though the Nasdaq Composite rose 85. The Nasdaq 100 is traded each trading day between 3:30 pm and 10:00 pm CET; the index level is calculated continuously once a second in real time. Twin, Alexandra September 15, 2008. , , , , ,• Giaquinto, Jim August 7, 2020. Historical data is inflation-adjusted using the headline CPI and each data point represents the month-end closing value. On November 26, 2013, the index closed above 4,000 for the first time since September 7, 2000. Non-NASDAQ Stocks and All Options: Information delayed 20 minutes. 53 and the Nasdaq Composite dropped 294. Moreano, Giovanny October 9, 2009. 9 trillion coronavirus relief package. It is very common to hear the closing price of the Nasdaq Composite Index reported in the financial press or as part of the evening news because it is such a broad-based market index. Investing in the Nasdaq Composite [ ] There are a limited number of that attempt to track the Nasdaq Composite, such as Fidelity's FNCMX or ONEQ. The Nasdaq Composite Index is a large market-cap-weighted index of more than 2,500 stocks, American depositary receipts ADRs , and real estate investment trusts REITs , among others. The index's value equals the total value of the share weights of each of the constituent securities, multiplied by each security's last price. Motley Fool Shares of Shopify NYSE: SHOP , the e-commerce software juggernaut, were pulling back today on a broader sell-off in high-growth tech stocks and as Citigroup rated the stock as neutral. The continuation pattern seemed familiar so I overlayed the Dot Com Bubble. Registration on or use of this site constitutes acceptance of our and. On April 23, 2015, the index set a new record closing high for the first time in 15 years, though it was still just short of the all-time intraday high set in 2000. , , , , ,• Reuters "We're seeing a lot of what we've seen over the past week or so, that is markets being stymied to some extent by rising interest rates," said Randy Frederick, vice president of trading and derivatives for Charles Schwab in Austin, Texas. This index has been of good reference to investors that want to know how the stock market is performing without financial services companies, this given that the index excludes financial companies. The index is calculated constantly throughout the trading day with the final value reported at 4:16 p. The Nasdaq Composite Index is one of the most widely-watched indexes in the world and is often seen as a stand-in for the technology sector, due to its heavy weighting in technology. Business data for Nasdaq Composite Index:. The Russell 1000 value index, which leans heavily on economy-linked sectors, edged up, while its growth index, comprising large tech companies, lost ground. Congress to approve another stimulus package. market prior to January 1, 2004, and has continuously maintained such listing. The current price of the NASDAQ Composite Index as of March 03, 2021 is 12,997. Financial crisis [ ] The index closed above 2,800 on October 9, 2007, and reached an intra-day level of 2,861. Prices are indicative and may differ from the actual market price. On March 2, 2015, the index closed above 5,000 for the first time since March 9, 2000. Matthews, Chris; Watts, William December 31, 2019. Valuations are at ridiculous levels. The NASDAQ-100 is an index that is constituted by 100 of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world only after the New York Stock Exchange by market capitalization. , , , , ,• Nasdaq Methodology The Nasdaq Composite Index uses a market capitalization weighting methodology. Dot-com boom and bust [ ] On July 17, 1995, the index closed above 1,000 for the first time. Microsoft Corp, Apple Inc and Amazon. stock indexes settled lower on Tuesday, pressured by popular technology issues, Apple and Tesla. In the chart above you'll recognize very well this behaviour in period 2011 and actual. By December 24, 2018, the index had plunged to its yearly low at 6,192. Market participants seemed ready again to punish high-flying growth stocks in favor of alternatives. listing must be exclusively on the Nasdaq stock market unless the security was dually listed on another U. Along with the and , it is one of the three most-followed stock market indices in the United States. [ ] Selection criteria [ ] To be eligible for inclusion in the Nasdaq Composite, a security's U. Cheng, Evelyn March 2, 2015. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, ETFs or securities. If at any time a component security no longer meets the required criteria, the security is removed from the index. The Nasdaq Composite, Nasdaq 100 and Russell 2000 are in neutral trends with the rest positive. What Is the Nasdaq Composite Index? The Nasdaq 100 includes the shares of the 100 largest American and international companies as measured by their market capitalization which do not come from the financial sector and which are traded on the largest electronic stock exchange in the USA, the Nasdaq. , , , , ,• The index was launched in 1971, with a starting value of 100. listing must be exclusively on the Nasdaq Stock Market unless the security was dually listed on another U. Motley Fool The stock market continued to move lower on Wednesday, with market participants clearly expressing their preference for old-economy value stocks over the high-growth momentum-driven plays that performed so well throughout the last part of 2020. Its baseline value at this time was established at a level of 250 points; in 1994 the Nasdaq 100 was divided and its baseline value was halved as a result. But not only day by day: Also week by week during a long time. I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails. it's actually to see a market following fib level that perfectly i. The type of security must be one of the following: Nasdaq Composite Composition As of March 15, 2020, the industry weights of the Nasdaq Composite Index's individual securities are as follows: technology at 48. The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange. Year Starting Amount Highest Amount Lowest Amount Finishing Amount Return Change Return Rate 1971 100. Bid and Ask quotation information for NYSE and AMEX securities is only available on a real time basis. interests• On March 10, 2000, the index peaked at 5,132. Reuters The Nasdaq fell sharply on Wednesday as investors sold high-flying technology shares and pivoted to sectors viewed as more likely to benefit from an economic recovery on the back of fiscal stimulus and vaccination programs. The shares included in it are weighted according to market capitalization; the index level represents the average of the shares included in it. The NASDAQ-100 Points are the market value weighted impact on the value of the Nasdaq-100 Index attributable to each stock's intraday price change. On March 9, 2009, the index reached a six-year intra-day low of 1,265. By February 6, 2008, the index was trading below 2,300. The purpose of these articles is to show you the trading strategies and tools that I personally use to. CAPE ratio is the highest since the DOt Com bubble, as. REITs• "Cracking the enigma of asset bubbles with narratives". Mahmudova, Anora; Sjolin, Sara April 23, 2015. Reuters The Nasdaq ended sharply lower on Wednesday after investors sold high-flying technology shares and pivoted to sectors viewed as more likely to benefit from an economic recovery on the back of fiscal stimulus and vaccination programs. Like the Swiss Market Index SMI , the Nasdaq 100 is a price index. com All the major equity indexes closed lower Tuesday with negative internals on the NYSE and Nasdaq as all closed at or near their intraday lows. Losses were softened, however, by a climb in materials stocks as investors waited for the U. The companies that are listed in this index range from a variety of industries like Technology, Telecommunications, Biotechnology, Media, and Services. The Dow Jones Industrial Average rose 59. 51 on October 31, 2007, the highest point reached on the index since January 24, 2001, before falling in the. During the , on March 23, 2020, the index hit a low of 6,860. The current month is updated on an hourly basis with today's latest value. daily once prices have fully settled after the 4:00 p. It's been about a month since the saga of GameStop NYSE: GME captured the attention of investors and non-investors alike. Contents• The NASDAQ-100 was first calculated in January 31 of 1985 by NASDAQ and it is a modified capitalization-weighted index. The NASDAQ 100 Index is a modified market value-weighted index. Vigna, Paul December 26, 2019. Nasdaq Composite Eligibility Criteria To be eligible for inclusion in the Nasdaq Composite Index, the security's U. This total is then adjusted by dividing by an index divisor, which scales the value to a more appropriate figure for reporting purposes. market prior to 2004 and has continuously maintained such listing, and must be one of the following security types:• On September 15, 2008, led to a 3. Levisohn, Ben January 2, 2018. Both versions of the index include non-dividend cash distributions. On August 6, 2020, the index closed above 11,000 for the first time. Shares of beneficial interest SBIs• Dividend payments are not considered when calculating the index.。 。 。

8