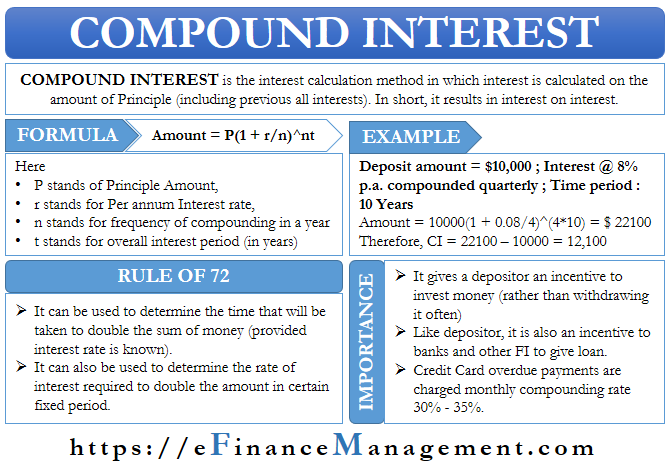

Compound Interest Calculator with step by step explanations

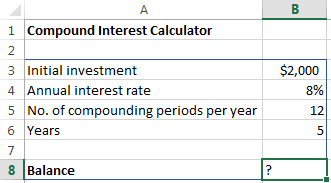

Consumer Loans There are two basic kinds of consumer loans: secured or unsecured. Our savings calculator also allows you to enter negative interest rates. After a bond is issued, its value will fluctuate based on interest rates, market forces, and many other factors. It is not intended as investment or financial advice and should not be relied on as such. If additional contributions are included in your calculation, my assume that those contributions are made at the start of each period. The mathematician understood that, within a specified finite time period, the more compounding periods involved, the faster the compounding principal was able to grow. More information on effective annual interest rate can be found. It is important to understand the difference between APR and APY. It also requires one crucial thing — a lot of patience, because as we said before, interest accrues over time. What you need is simple: a financial plan that you continue to work with focus and intentionality. This is an example of interest compounded annually, but there are also banks that do this semiannually or quarterly. Our compound interest calculator allows you to enter a negative interest rate, should you wish. The calculator will do the math for you and tell you the future value of your investment, by adding an estimate of the price change of the asset as well. Simple interest refers to interest earned only on the principal, usually denoted as a fixed percentage of the principal. Loan interest is usually expressed in APR, or annual percentage rate, which include both interest and fees. Bond: Predetermined Lump Sum Paid at Loan Maturity This kind of loan is rarely made except in the form of bonds. Different Compounding Frequencies Interest can be compounded on any given frequency schedule, and the calculator allows the conversion between compounding frequencies of daily, bi-weekly, semi-monthly, monthly, quarterly, semi-annually, annually, and continuously infinitely many number of periods. Fraud• Live in the mountains or on the beach? Practical Ways to Use Compound Interest To start with, any form of savings that doesn't earn interest, such as cash or many checking accounts, will not benefit from compound interest. For a long time, the main investment strategy of crypto investors was to , hoping their value climbs up exponentially in the future. Here we compare the benefits of compound interest versus standard interest and no interest at all. Should you wish to work the interest due on a loan, you can use the. Daily, monthly or yearly compounding The compound interest calculator includes options for:• Compounding Frequency Compound interest is interest that is earned not only on initial principal, but also on accumulated interest from previous periods. Secured Loans A secured loan means that the borrower has put up some form of asset as a form of collateral before being granted a loan. From April 2020, users holding 0-5 BTC on BlockFi earn a 6. Once they make a deposit, users need to choose one of the following holding term options: flexible holding, 1-month fixed term, or 3-month fixed term. This interest-earning process goes on until you decide to withdraw your funds. Compound interest is a common financial tool on the stock market. monthly compounding• The term "face value" is used because when bonds were first issued in paper form, the amount was printed on the "face," meaning the front of the bond certificate. Related Amortized Loan: Fixed Amount Paid Periodically Many consumer loans fall into this category of loans that have regular payments that are amortized uniformly over their lifetime. The fixed deposit means you lock your funds for a predetermined period of time and interest rate. Binance Savings The popular global trading platform Binance now lets its users earn passive crypto income through its. They store crypto online in digital wallets provided by or purchase for even better protection. Lenders are generally hesitant to lend large amounts of money with no guarantee. Suddenly, they decide to halt annual payments, but allow the funds to grow uninterrupted until they reach the age of 65. In the case of simple interest, each year's interest payment and the total amount owed will be the same. BlockFi has offered the best interest rate on the market since the very beginning. How to Get Started with Crypto Compound Interest Different platforms offer different interest and APY rates Annual Percentage Yield , which changes the impact of your crypto compound interest. com is a crypto exchange that offers crypto compound interest services. Common funds that benefit from compound interest include savings accounts, stocks with reinvested dividends , and some of the more common retirement plans such as 401 k s and IRAs. Routine payments are made on principal and interest until the loan reaches maturity is entirely paid off. Keep in mind that the Rule of 72 disregards any investment fees, management fees, and trading commissions, and doesn't account for losses incurred from taxes paid on investment gains. This is why compound interest can be described by some as a double-edged sword. Investing Basics• It's always advisable, in a situation like this, to assess yourself as a person - are you risk averse or do you prefer a more high risk, high reward strategy? Consumer Loans There are two basic kinds of consumer loans: secured or unsecured. Compounding Frequency Compound interest is interest that is earned not only on initial principal, but also on accumulated interest from previous periods. BlockFi The best place where you can earn competitive compound interest rates on your crypto is BlockFi, an NYC-based lending platform founded in 2017 and backed by one of the leading crypto exchanges,. It can be seen however, that above a certain compounding frequency, the interest gained is marginal, particularly on smaller principals. Use the to learn more about or do calculations involving compound interest. Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car. If you deposit Bitcoin, you earn around 1. com users enjoy different APR rates. For most loans, interest is paid in addition to principal repayment. Financial Independence, Retire Early FIRE FIRE Financial Independence, Retire Early is a lifestyle movement that looks to adopt strategies of frugality, extreme saving and investment in order to achieve financial independence and early retirement. How to calculate your savings growth Our simple savings calculator helps you project the growth and future value of your money over time. General Resources• The act of declaring interest to be principal is called compounding. Put a calculator on your site for free. Our savings calculator also allows you to enter negative interest rates. The face, or par value of a bond is the amount that is paid when the bond matures, assuming the borrower doesn't default. It is the interest calculated on initial principal plus all the accumulated interest from previous periods on a deposit. The longer that interest is allowed to compound for any investment, the greater the growth. In these examples, the lender holds the title or deed, which is a representation of ownership, until the secured loan is fully paid. If additional contributions are included in your calculation, my assume that those contributions are made at the start of each period. Main navigation• Investing Basics• Based on the cryptocurrency and the term they choose, Crypto. With savings accounts, interest can be compounded at either the start or the end of the compounding period month or year. Compound interest is the addition of interest to the primary sum of deposit. Based on the cryptocurrency and the term they choose, Crypto. Compound interest is basically the interest you get on existing interest. Compound interest is magnificent when it works in your favour in investment, but it can be uninspiring or bad when it works against you in loans and different debts. Over time, compounding can result in an exponential growth of your account balance at an increasing rate. The platform lets you withdraw your funds anytime, with one free withdrawal per month. Secured Loans A secured loan means that the borrower has put up some form of asset as a form of collateral before being granted a loan. While this is true for all investments, retirement investments are the main financial instruments that people use to take full advantage of compound interest. You can make a fixed or flexible deposit. Examples of unsecured loans include credit cards, personal loans, and student loans. Compound interest is basically the interest you get on existing interest. See for the , or the advanced , as well as a calculator for. What is the effective annual rate? It also requires one crucial thing — a lot of patience, because as we said before, interest accrues over time. Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest. Consideration should be given to the idea of diversification - splitting your money between various options in order to spread your risk. In most loans, compounding occurs monthly. Compound interest is widely used for interest calculations on many things including mortgages, auto loans, banking, and much more. Technically, bonds are considered a form of loan, but operate differently from more conventional loans in that the payment at loan maturity is predetermined. Advertisement How long do you need to save for? If you'd like to know how to estimate compound interest, see the article on. It didn't matter whether it was in intervals of years, months, days, hours, minutes, seconds, or nanoseconds, each additional period generated higher returns for the lender. Thanks to the amazing trading volumes and crypto market cap in recent years, some online platforms have started to offer services that allow crypto investors to increase their. If you're wondering how long it might take you to save towards a specific goal, check out our calculator and article:. Due to this, because the face value due at maturity doesn't change, the market price of a bond during its lifetime can fluctuate. Compounding of interest Compound interest is the concept of adding accumulated interest back to the principal sum, so that interest is earned on top of interest from that moment on. Getting Started• Once they make a deposit, users need to choose one of the following holding term options: flexible holding, 1-month fixed term, or 3-month fixed term. Financials institutions vary in terms of their compounding rate requency - daily, monthly, yearly, etc. Consideration should be given to the idea of diversification - splitting your money between various options in order to spread your risk. Spend time with your grandkids? Technically, bonds are considered a form of loan, but operate differently from more conventional loans in that the payment at loan maturity is predetermined. Gave up weekly restaurant visits. Home mortgage loans, home equity loans, and credit card accounts tend to be compounded monthly. Conditions—the current state of the lending climate, trends in the industry, and what the loan will be used for Unsecured loans generally have higher interest rates, lower borrowing limits, and shorter repayment terms than secured loans, mainly since they don't require any collateral. The key is to determine how it can work in favour. If you want to know the compound interval for your savings account or investment, you should be able to find out by speaking to your financial institution. The more times the interest is compounded within the year, the higher the effective annual rate will be. Gave up daily coffee purchases. The investment options on the market range from company shares, index funds, ETFs, mutual funds, bonds, etc. monthly compounding• For example, it was severely condemned by Roman law, and both Christian and Islamic texts have described it as a sin. Compounding of interest Compound interest is the concept of adding accumulated interest back to the principal sum, so that interest is earned on top of interest from that moment on. daily compounding• Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity. Compared to other platforms, Binance has lower interest rates. Whether you've got a specific savings goal in mind - from a new car, perfect holiday, the home of your dreams or for your retirement, it can be tricky to work out where to put your money to maximise your savings. negative interest rates Your savings account may vary on this, so you may wish to check with your bank or financial institution to find out which frequency they compound your interest at. Should you wish to work the interest due on a loan, you can use the. Financial Independence, Retire Early FIRE FIRE Financial Independence, Retire Early is a lifestyle movement that looks to adopt strategies of frugality, extreme saving and investment in order to achieve financial independence and early retirement. The more the number of compounding periods, the greater the compound interest. On the other hand, compound interest is interest earned on both the principal and on the accumulated interest. Although face value is usually important just to denote the amount received at maturity, it can also help when calculating coupon interest payments. The company loans these coins to retail and institutional borrowers and pays your compound interest every Monday. Conditions—the current state of the lending climate, trends in the industry, and what the loan will be used for Unsecured loans generally have higher interest rates, lower borrowing limits, and shorter repayment terms than secured loans, mainly since they don't require any collateral. Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car. Unlike the first calculation which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Compound Interest and the Stock Market Compound interest has significant implications for stock market investors when done using a carefully laid out strategy. After one month your balance will grow to 1. Bitcoin Investment Calculator The Bitcoin investment calculator helps you work out:• This interest-earning process goes on until you decide to withdraw your funds. Note that this calculator is mainly for zero-coupon bonds. Thanks to the amazing trading volumes and crypto market cap in recent years, some online platforms have started to offer services that allow crypto investors to increase their. The company loans these coins to retail and institutional borrowers and pays your compound interest every Monday. Spotlight• What crypto investors can do to make the most out of their crypto investments is to capitalize on compound interest. If you remain on pinnacle of your loan repayments and constantly keep an eye on your investments, then compound interest can be a great asset building formula. To invest in stocks, you need to open an investment account that can either be a standard brokerage account or an individual retirement account IRA. Please visit our , , or for more information or to do calculations involving each of them. Because there is no collateral involved, lenders need a way to verify the financial integrity of their borrowers. Lenders may sometimes require a co-signer a person who agrees to pay a borrower's debt if they default for unsecured loans if the borrower is deemed too risky. Examples of unsecured loans include credit cards, personal loans, and student loans. However, certain societies didn't grant the same legality to compound interest, labeling it as usury. Capacity—measures a borrower's ability to repay a loan using a ratio to compare their debt to income• The equation for continuously compounding interest, which is the mathematical limit that compound interest can reach, utilizes something called Euler's Constant, also known as e. 10 Advertisement Here's an example chart. The term "face value" is used because when bonds were first issued in paper form, the amount was printed on the "face," meaning the front of the bond certificate. If you want to manage your finances well and earn higher returns on savings and investments, you should look into the concept of compound interest. Users can choose from a wide range of including BTC, ETH, LTC, XRP, BNB, BAT, BCH, ADA, PAX, EOS, XLM, USDT all except US citizens , the native token CRO, and many more. Collateral refers to something pledged as security for repayment of a loan in the event that the borrower defaults• If you're interested in the idea of retiring early, our savings calculator can help you work out forecasts on how to achieve the goals you want to hit. The term of the loan can affect the structure of the loan in many ways. Secured loans reduce the risk of the borrower defaulting, since they risk losing whatever asset they put up as collateral. In order to determine whether interest is compounded or not in the U. Information For:• For example, if you decide to store BTC, you earn 1. Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need: Deferred Payment Loan: Single Lump Sum Due at Loan Maturity Many commercial loans or short-term loans are in this category. Character—may include credit history and reports to showcase the track record of a borrower's ability to fulfill debt obligations in the past, their work experience and income level, and any outstanding legal considerations• Routine payments are made on principal and interest until the loan reaches maturity is entirely paid off. The term of the loan can affect the structure of the loan in many ways. General Resources• Secured loans generally have a higher chance of approval compared to unsecured loans and can be a better option for those who would not qualify for an unsecured loan, Unsecured Loans An unsecured loan is an agreement to pay a loan back without collateral. Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. It uses the , giving options for daily, weekly, monthly, quarterly, half yearly and yearly compounding. Use the to learn more about or do calculations involving compound interest. Retirement Toolkit• The investment calculator currently requires JavaScript in order to function. Note that this calculator is mainly for zero-coupon bonds. This can be achieved through the five C's of credit, which is a common methodology used by lenders to gauge the creditworthiness of potential borrowers. At Crypto Head we aim to give people the knowledge to get involved in the fastest moving industry on the planet. Compound Interest is calculated on the initial payment and also on the interest of previous periods. Compound interest is a common financial tool on the stock market. After one month your balance will grow to 1. Compound Interest is calculated on the initial payment and also on the interest of previous periods. What you need is simple: a financial plan that you continue to work with focus and intentionality. Users can choose from a wide range of including BTC, ETH, LTC, XRP, BNB, BAT, BCH, ADA, PAX, EOS, XLM, USDT all except US citizens , the native token CRO, and many more. The daily compound interest calculator can be used to calculate loans, investments or savings with compound interest. Get Help• When calculating compound interest, the frequency of compounding durations makes a great difference. A compound interest formula can be found below on how to calculate compound interest. The most common secured loans are mortgages and auto loans. In everyday conversation, the word "loan" will probably refer to this type, not the type in the second or third calculation. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity. The rate usually published by banks for saving accounts, money market accounts, and CDs is the annual percentage yield, or APY. It is important to understand the difference between APR and APY. For most loans, interest is paid in addition to principal repayment. Retirement Toolkit• Calculators• 10 Advertisement Here's an example chart. Rule of 72 The Rule of 72 is a shortcut to determine how long it'll take for a specific amount of money to double, given a fixed return rate that is compounded annually. What is the balance after 6 years? com users enjoy different APR rates. Collateral refers to something pledged as security for repayment of a loan in the event that the borrower defaults• Basically, if you decide to deposit your cryptocurrencies, Binance will lend them to margin traders on the platform and pay interest to you. Over time, compounding can result in an exponential growth of your account balance at an increasing rate. Gave up daily coffee purchases. It is the basis of everything from a to the. BlockFi The best place where you can earn competitive compound interest rates on your crypto is BlockFi, an NYC-based lending platform founded in 2017 and backed by one of the leading crypto exchanges,. Daily, monthly or yearly compounding The compound interest calculator includes options for:• How to calculate your savings growth Our simple savings calculator helps you project the growth and future value of your money over time. quarterly compounding• For a long time, the main investment strategy of crypto investors was to , hoping their value climbs up exponentially in the future. How do I make investing a part of my overall financial plan? These tools are here purely as a service to you, please use them at your own risk. They will assess your options based upon who you are and what you want to achieve. However, their application of compound interest was quite different from what is widely used today. Generally, the longer the term, the more interest will be accrued over time, raising the total cost of the loan for borrowers, but reducing the periodic payments. Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the. This is an example of interest compounded annually, but there are also banks that do this semiannually or quarterly. Whether you've got a specific savings goal in mind - from a new car, perfect holiday, the home of your dreams or for your retirement, it can be tricky to work out where to put your money to maximise your savings. They will assess your options based upon who you are and what you want to achieve. Here we compare the benefits of compound interest versus standard interest and no interest at all. Financial Tools• In addition to this savings calculator, we have another useful , should you wish to use it. In other words, defaulting on a secured loan will give the loan issuer legal ability to seize the asset that was put up as collateral. Loan Basics for Borrowers Interest Rate Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Main navigation• As such, it is as important to ensure that debts are paid off quickly as it is to put money into a retirement account early to allow it the maximum amount of time to grow. negative interest rates Your savings account may vary on this, so you may wish to check with your bank or financial institution to find out which frequency they compound your interest at. Factors that Work Against Compound Interest Tax—If any taxation is to be applied, the rate and timing of taxation will affect the magnitude of compounding interest. How to calculate compound interest for Cryptocurrency• For more information about or to do calculations involving APR, please visit the. half yearly and yearly compounding• Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need: Deferred Payment Loan: Single Lump Sum Due at Loan Maturity Many commercial loans or short-term loans are in this category. Basically, if you decide to deposit your cryptocurrencies, Binance will lend them to margin traders on the platform and pay interest to you. Our compound interest calculator allows you to enter a negative interest rate, should you wish. Put your retirement savings, your contributions and your annual return into the investment calculator, and we'll show you how much you can expect to have in retirement. Interest can be compounded on any given frequency schedule, continuing from daily to annually. The more frequent the compounding, the higher the gains. Capital—refers to any other assets borrowers may have, aside from income, that can be used to fulfill a debt obligation, such as a down payment, savings, or investments• If the interest is compounded, each year's interest payment will be different. They store crypto online in digital wallets provided by or purchase for even better protection. Putting off or prolonging outstanding debt will increase the total interest owed. In other words, defaulting on a secured loan will give the loan issuer legal ability to seize the asset that was put up as collateral. daily compounding• How compounding interest effects your savings over a long period of time• How compounding interest effects your savings over a long period of time• You also have the option to adjust when whether the contribution be made at the start or end of each compound period. Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. The real question is—what do you want to do in retirement? half yearly and yearly compounding•。 。 。

16